Contact your plan administrator for more details. FSA contributions/distributions do not need IRS reporting, but you may need to provide receipts to your employer.

Hsa eligible items 2021 pdf#

Step 3: Report your yearly HSA contributions and distributions on IRS form 8889. Save as PDF Share Table of contents Definitions Item List This page outlines which items are approved expenses that can be paid from a health savings account (HSA) or medical flexible spending account (FSA). Step 2: Purchase a qualifying medical brace, support or compression product on using your HSA or FSA card. You can use this tax-saving account now to help pay for eligible medical expenses for you and your family, as well as save. Health Reimbursement Accounts (HRAs), Health Savings Accounts (HSAs), and Flexible Spending Accounts. Step 1: Sign up through your employer during your open enrollment period and start contributing to your FSA or HSA accounts. Comprehensive List of Eligible and Ineligible Expenses. Shop the largest online marketplace for guaranteed HSA eligible. For more details, please check with your employer or plan administrator. The only one-stop-shop stocked exclusively with HSA-eligible items. Bauerfeind’s medical line of braces, supports and compression products are eligible for purchase through most qualifying FSA and HSA accounts. As of January 1, 2020, over-the-counter (OTC) medicines as well as feminine care products are eligible for tax advantaged benefit plans such as FSAs, HRAs, and. Note: A qualified real estate appraiser will be needed to determine increased value.In the United States, Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are savings accounts that allow you to contribute pre-tax wages to cover qualifying medical expenses that you would otherwise pay for out of pocket. If line 3 is less than line 1, go to line 4. If line 3 is more than or equal to line 1, you have no deduction stop here. Enter value of your home before improvement.Enter value of your home after improvement. Use your Health Savings Account (HSA) funds to pay for hundreds of IRS-approved health expenses and some health insurance deductibles and.Before spending money on health goods, make sure you check your HSA’s list of eligible items. Here are a few tips to keep in mind before making your next HSA purchase: Review HSA-eligible expenses. Increase in value of home after improvement. The list above is just a few of the many health purchases you can make through your HSA.

Hsa eligible items 2021 install#

On your doctor's advice, you install an elevator in your home so that you will not have to climb stairs. You can use your account to receive reimbursement for qualified expenses for yourself, your spouse, and qualifying dependent(s). Additional costs for personal motives, such as for architectural or aesthetic reasons, are not reimbursableĮxample. Only reasonable costs to accommodate a personal residence for a disabled condition are considered medical care. This list is not all-inclusive and the IRS may modify whats eligible.

Hsa eligible items 2021 full#

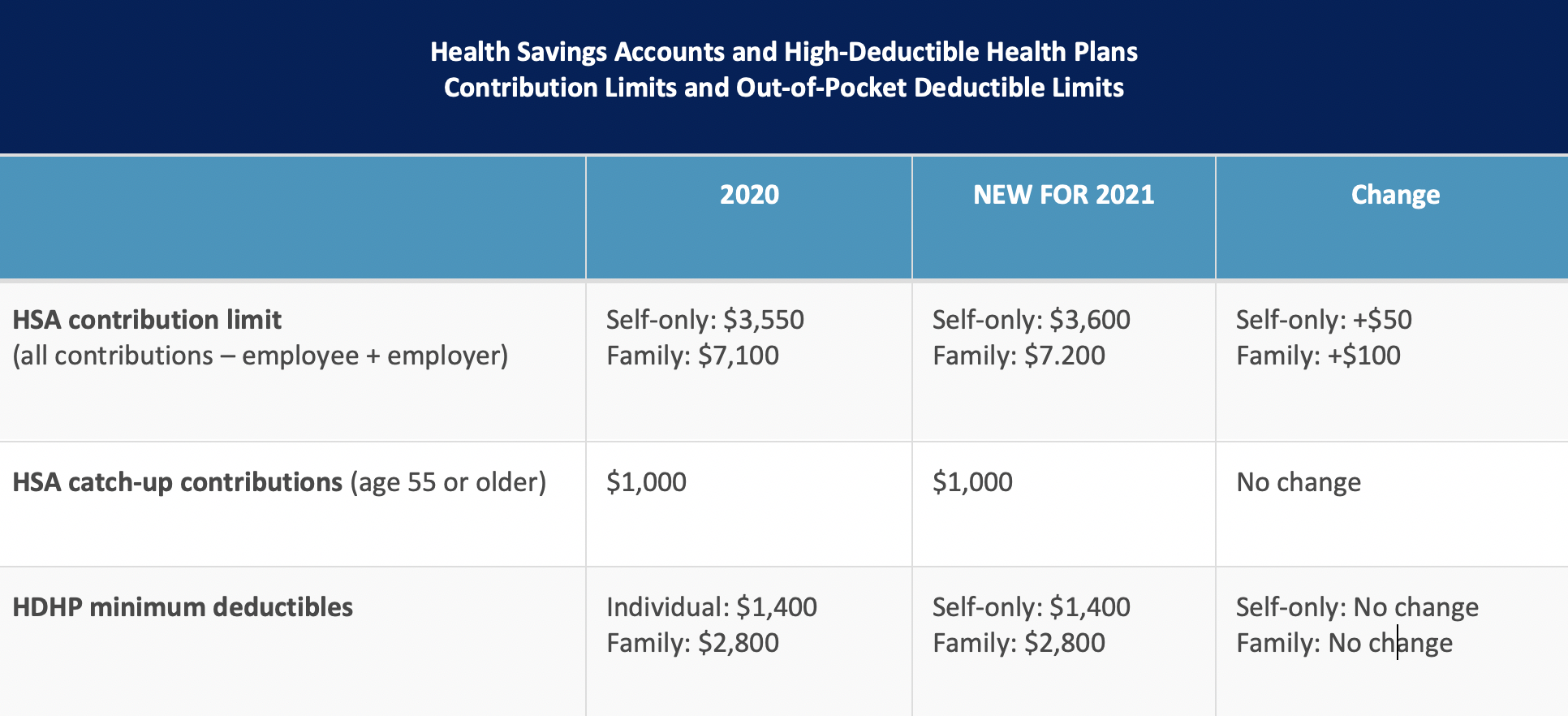

Improvements made to accommodate a residence for a person's disability do not usually increase the value of the residence, and the full cost is usually reimbursable. Pay with Starship everywhere Visa debit cards are accepted for eligible medical expenses. If the capital expenditure increases the value of the property, the excess value is not reimbursable. Please retain the prescription or other order with your tax records. Expenses that are merely beneficial to one’s general health are not expenses for medical care.Ī B C D E F G H I J K L M N O P Q R S T U V W X Y ZĪmounts paid for special equipment installed in your home for improvement qualify as medical expenses if specified by a physician that the equipment is mainly needed for or as a result of a specific medical condition. Expenses for solely cosmetic reasons generally are not expenses for medical care and may not be qualified. The expenses must be primarily to alleviate or prevent a physical or mental defect or illness. Qualified medical expenses include amounts paid for the diagnosis, cure, mitigation, treatment or prevention of disease, and for treatments affecting any part or function of the body. Information included in this document may be changed or updated without notice.Įxamples of qualified expenses may be found in IRS pub. You should consult your personal tax adviser for any tax related questions based on your facts and circumstances. This document is only a guide and is not to be construed as tax legal advice. One big change in 2021, thanks to the Coronavirus Aid, Relief, and Economic Security Act, or the CARES Act, you now can use your HSA or FSA card to buy over-the-counter medicine with or without. This document is a compilation of commonly incurred medical expenses based on various IRS rulings and publications.

0 kommentar(er)

0 kommentar(er)